As flyer habits change, airlines rethink approach to scheduling: Travel Weekly

The changing travel patterns brought about by the pandemic have caused the Big Three U.S. airlines to begin a readjustment of their decades-old approach to flight scheduling.

American, Delta and United have for years largely built their schedules with a focus on the peak days and times of their corporate customer flights.

Now, motivated by the growth of hybrid business and leisure trips as well as lingering drop-offs in managed business travel, which continues to lag 2019 levels by approximately 20%, those scheduled peaks and troughs could become less dramatic. That would mean less variability in flight frequency over the course of given days, between days of a given week and even potentially between different times of the year.

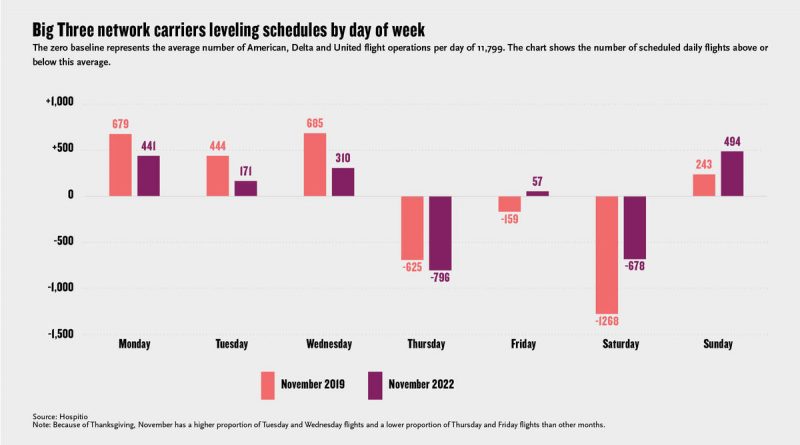

“We are definitely seeing a shift toward a more level schedule by day of week among the Big Three network carriers,” said John Wickson, executive principal with Hospitio, a travel industry consultancy.

Using information provided by the airline industry data company Milanamos, Wickson said that the schedules of American, Delta and United this November have shifted an average of 165 flights per day toward a fully level schedule across the seven days of the week in comparison to 2019.

“This may not sound like a lot, but it’s an average daily reduction of 28% in the typical day’s deviation from a fully level schedule,” Wickson said.

Five of the seven days of the week in November will have a number of flights closer to the overall average number of Big Three flight operations per day of 11,799 than they had in 2019, Wickson said.

The adjustments jibe with remarks made by United, American and Deta executives during recent earnings calls. The carriers stated that the demand spike over Thanksgiving will be less concentrated on one or two days this year and instead will be spread more evenly over the holiday week. A similar pattern is showing up in bookings for the winter holidays as the many travelers who are no longer confined to an office extend trips and work from wherever they happen to be.

Meeting shifting demand

Evidence of shifting demand also showed up clearly in September, with airlines reporting that the usual sharp drop in leisure flying didn’t materialize.

“It does not appear that summer has come to an end, it’s that strong,” United senior vice president of global network Patrick Quayle said in mid-September as he referenced demand to Mexico, the Caribbean and Europe.

One adjustment United is already making to facilitate these new travel patterns will show up in transatlantic flight schedules this winter as some city pairs that previously would have seen a service cut to five times per week will remain daily, chief commercial officer Andrew Nocella said. The carrier has also buffered its schedule during normally slow early December by a couple of percentage points to handle more even demand patterns across the month.

At American, said chief commercial officer Vasu Raja, network planners have detected demand growth during normally quiet periods of the week, such as Wednesday evenings and Thursday mornings.

The carrier has also seen 2 percentage points of daily traffic shift from the peak business periods of before 8 a.m. and after 4 p.m to the periods between those hours.

Fewer flights to start the week

Still, while the Big Three have begun smoothing their schedules, not every airline is doing so.

Allegiant, which has long scaled its schedule up and down according to the day of the week in a far more pronounced pattern than the Big Three carriers and has never relied on business traffic, has only made those weekday differences more substantial, Wickson said.

An analysis of flight scheduling data provided by OAG for the second full week of October shows that, globally, airlines reduced their share of flying, relative to 2019, on Monday, Tuesdays and Wednesday, while slightly increasing proportions during the traditionally busy days of Friday and Sunday. On normally slow Saturday, however, flight schedules were also beefed up.

Rebecca Rowland, an analyst at OAG and a partner at the U.K.-based consultancy Midas Aviation, said those figures point to the share-shift toward leisure travel that the airline industry has experienced since the onset of the pandemic.

But, said airline industry analyst Bob Mann of R.W. Mann & Co., each carrier will respond to shifting demand patterns according to their own business models and target customers.

“The planning cycle used to be a ponderous thing, an 18- to 24-month process,” he said. “Now, maybe it’s an 18-day to 24-day process and then one month to get it implemented. I think the industry has really done a good job of accelerating the planning cycle.”

Source: Read Full Article