Preview 2023: Airlines

After three years of turmoil, signs are pointing toward a relatively stable year for the U.S. airline industry in 2023. Ticket prices, which jumped sharply in 2022, could stay high due to high demand and constrained seat capacity. Meanwhile, airlines appear to have put the operational problems that especially plagued flyers in the spring and early summer in the rearview mirror.

And employment may have returned to normal levels, perhaps even going a big higher. “It looks like most airlines have gone up quite a bit in overall head count versus prepandemic,” said Brad Beakley, CEO of the travel industry consultancy Hospitio. “I think that does bode well.”

To give one example, Southwest expects staffing numbers, net of attrition, to be up more than 10,000 for the year, followed by another 8,000 in 2023, CEO Bob Jordan said in late November.

Staffing increases, combined with schedule paring, were key factors in U.S. airlines canceling just 0.3% of scheduled flights during Thanksgiving week.

Beakley said that as new employees grow into their roles, airlines should operate with increasing efficiency.

Airlines especially struggled in 2022 with a shortage of pilots, a constraint they say will remain in place for much or all of 2023. But while airlines did eventually adjust their schedules to reflect pilot constraints, Beakley cautioned that not every airline handles these matters in the same way.

American, he pointed out, is flying a much more peaked schedule in the second half of December versus the first half compared with Delta. In 2023, airlines that take more aggressive approaches to scheduling up for peak times could be at risk of new operational problems.

“Delta’s strategy really does give them a little more flexibility to make sure their operation stays on track,” Beakley said. “Anything that varies more day to day will make it more difficult to operate consistently.”

Despite widespread concerns of a looming recession, analysts see few signs that fares will drop significantly in 2023.

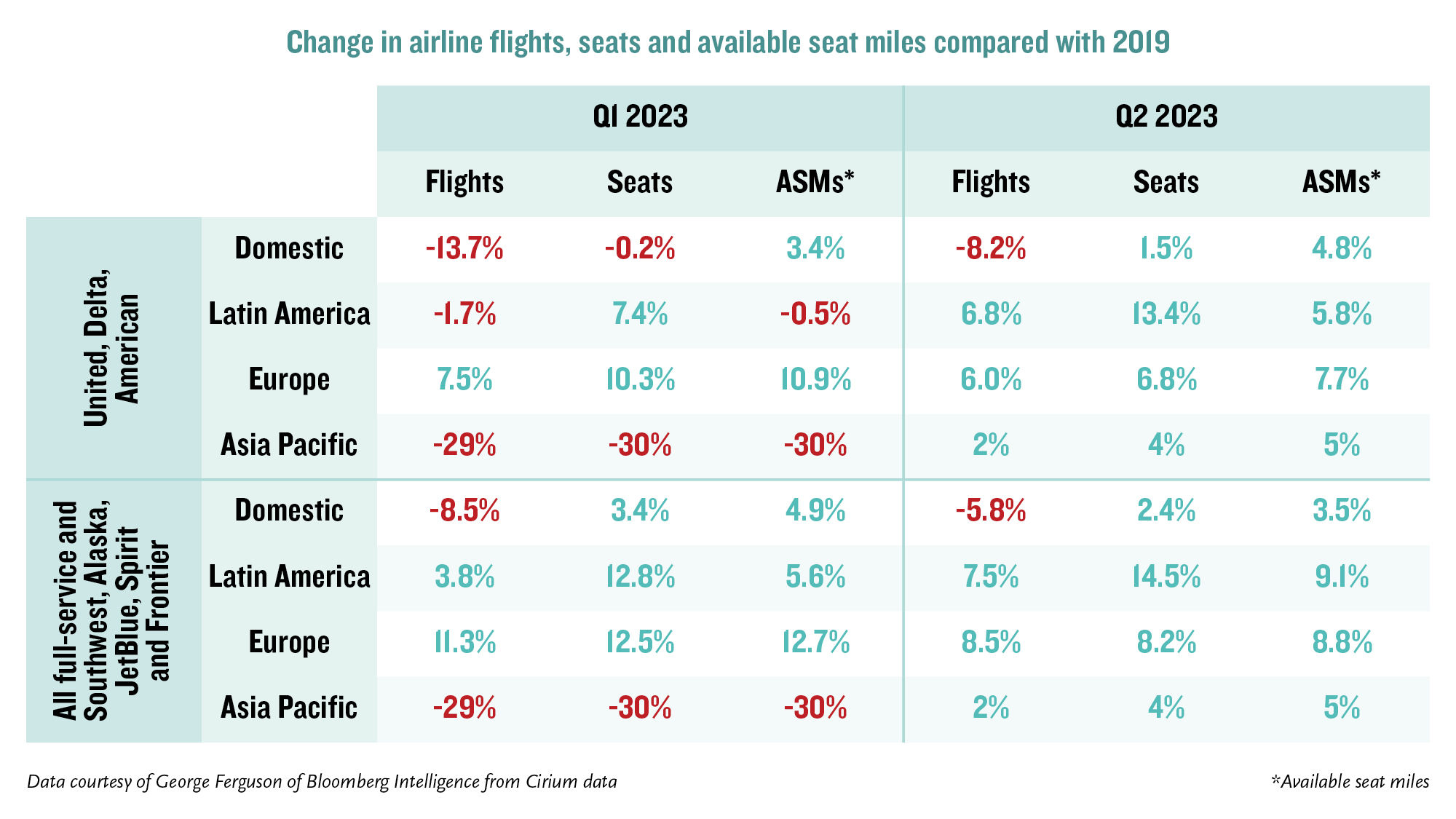

Carriers have continued to report steady demand. One factor favoring high ticket prices could continue to be capacity levels. According to a review of Cirium flight schedule data by Bloomberg Intelligence aviation industry analyst George Ferguson, the Big Three U.S. airlines of American, Delta and United are currently slated to fly 0.2% fewer domestic seats in the first quarter than they did in the same quarter in 2019 and 1.5% more seats in the second quarter than in 2019.

For all U.S. carriers, the domestic seat count for the second quarter is scheduled to be up 2.4% from 2019. Increases will be larger for the Latin America, European and even Asian markets.

But Ferguson predicts that airlines will pare schedules as those dates approach.

“I think that labor issue persists,” he said. “It does keep them from flying the 2019 level. I think this schedule is the best case.”

As to fares, Ferguson projects softening in line with an expected economic slowdown and as pent-up travel demand is exhausted.

“As we get into the summer flying season, I think the question is: How is the consumer holding up?” he said. “If it’s not too bad, it could be a soft landing.”

Hopper economist Hayley Berg said she expected U.S. travelers to continue to face high airfare on flights to some international markets in 2023, especially Asia, portions of which have only recently reopened, and Europe, where the weak euro is boosting demand.

As far as domestic price trends, Berg said she expects to learn a lot in early January.

“What I’m seeing so far is higher prices for early 2023 departures,” she said. “Until we see something different, I’m going to expect that’s what we’re going to see.”

Source: Read Full Article